Police, schools, and other local services are often funded by your local county government. Property taxes are the biggest contributor to local government revenues. In 2020, they were responsible for 72 percent of local tax collections nationally, according to the Tax Foundation.

Though each county has its own property tax rate, North Carolina’s effective property taxes are the 19th lowest among states.

In North Carolina, counties tax properties using a revenue-neutral system. Revenue neutral is a form of tax collection where the county lands on a dollar amount first, then calculates the tax rate according to that revenue amount, while also accounting for growth.

North Carolina requires counties to conduct property value reassessments at least every eight years, though many counties choose to reassess more frequently. Twenty-four counties will complete reassessments in 2023.

Reassessments capture the change in housing values. Even so, the housing market can vary significantly over 8 years, as housing booms are followed by busts. Thirty-two counties in North Carolina have reassessments only every 8 years.

Property taxes generally follow the “user pays principle” since the people paying property taxes benefit from the local government services. Even so, families with no school-aged children are still paying for property taxes that fund local public education. Property taxes are also transparent. This is not the case for taxes on intangible property like inventory, estate, or inheritance taxes. According to the Tax Foundation, “States are in a better position to attract business investment when they maintain competitive real property tax rates and avoid harmful taxes on tangible personal property, intangible property, wealth, and asset transfers.”

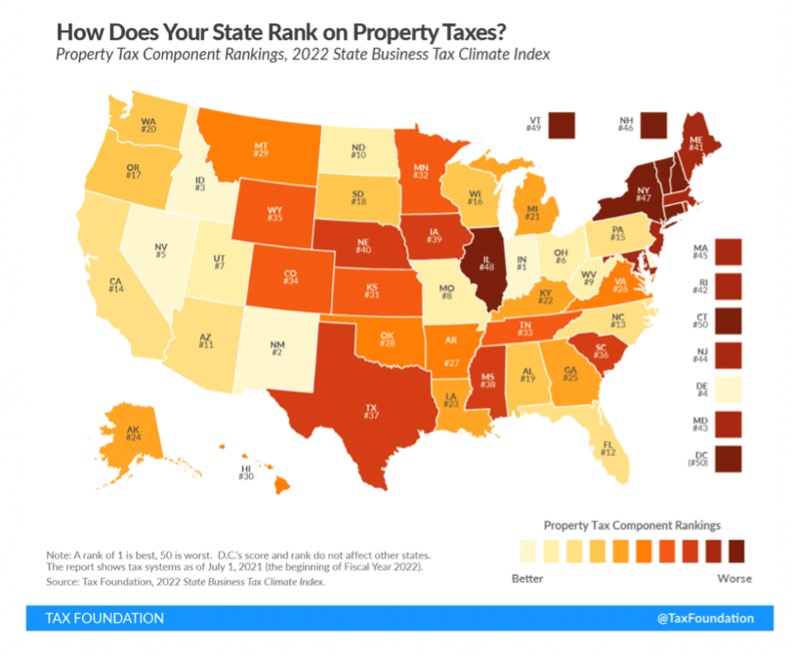

North Carolina ranked 13th best on the Tax Foundation’s property tax component of the State Business Tax Climate Index for the last three years.