- North Carolina was in the top 10 states with the highest average hospital Medicare profit margins for five years.

- Hospitals across North Carolina claimed to lose $3.1 billion on Medicare in 2020 when they received $87 million in profits.

- The North Carolina State Health Plan faces insolvency in three years if something isn't done soon.

Treasurer: N.C. hospitals profiting, not losing money on Medicare

Published October 27, 2022

By Teresa Opeka

A report released Tuesday by North Carolina Treasurer Dale Folwell shows that most hospitals in the state are profiting from overcharging patients while claiming they are losing substantial amounts of money on Medicare.

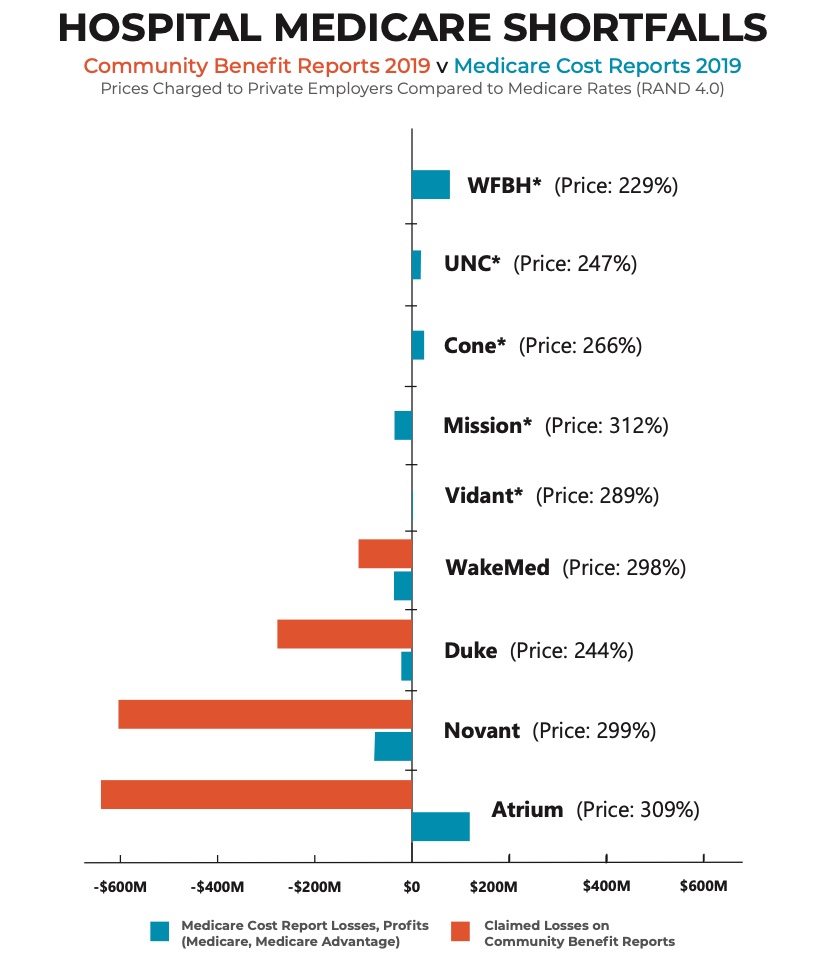

The report shows that hospitals claimed they lost $3.1 billion on Medicare in 2020 when they received $87 million in profits. For context, the questionable loss claim was 3,670% larger than the hospitals’ self-reported Medicare profits.

“The difference we are talking about here is hundreds of billions of dollars,” said Folwell during a press conference. “It’s especially important in this environment when we are dealing with an inflationary situation where the cost of living is going up. I don’t think we have seen the inflation of healthcare premiums, which I think is coming down the pike in the next few months.”

Researchers from the State Health Plan and Rice University’s Baker Institute for Public Policy analyzed hospitals’ self-reported Medicare cost reports, Internal Revenue Service 990 tax filings, and community benefit reports. The report was then peer-reviewed by the University of Southern California’s Price School of Public Policy.

The North Carolina Healthcare Association, the lobbying group for hospitals across the state, says the report uses “misinformation and half-truths.” The organization reports that, because hospitals cannot negotiate reimbursement rates like they would with commercial insurance, Medicare payments covers about 84 cents of every dollar spent by a hospital.

However, North Carolina was in the top 10 states with the highest average hospital Medicare profit margins for five years, according to Medicare Cost Report data. The data also found that only 15 hospitals consistently lost money on Medicare, while 35 hospitals posted profits over all six years in the state.

In addition, 55% to 66% of more than 100 hospitals profited from Medicare from 2015 through 2020.

The treasurer’s office said Medicare Cost Report data is considered one of the most reliable hospital data sources.

It’s different from hospital community benefit reports, which rarely publish a transparent methodology and hospitals’ tax filings to the Internal Revenue Service.

“What was more disturbing was what Treasurer Folwell’s team found about the IRS 990 numbers in North Carolina relative to those Medicare cost reports is that they are misleading,” said Dr. Vivian Ho, Rice University Baker Institute for Public Health. “It’s impossible to tell why their numbers are so different, and I think it’s one of those cases where we do need to have some policy to require more accurate reporting of what’s going on because not only are employers and the state paying too much for their health insurance, but it is also the case that North Carolinians are losing out on community benefits that these nonprofit hospitals should be contributing back to the public because of the tax breaks they receive.”

Dr. Ho said they also found that the hospitals’ profits on Medicare are going towards cash reserves. They’re using it to borrow against it to issue bonds, build more facilities, and expand their market, increasing their ability to charge even higher prices.

Folwell said hospitals need to stop making secret contracts and be upfront with pricing, as directed by the Trump Administration and made stronger by the Biden Administration, who were both sued by the Hospital Administration and the Chamber of Commerce. Both entities lost twice in federal court.

He said none of the CEOs at the state’s major hospitals have responded to his inquiry over rumors he has heard over the past few weeks of even further consolidation of health care in the state.

The report said that lobbyists attributed 52% of hospitals’ community benefit spending to Medicare losses in 2020. Novant Health, for example, claimed a Medicare loss that eclipsed all its other community benefit spending combined in 2019, including charity care and Medicaid losses. Atrium Health made a $119.2 million profit on Medicare and Medicare Advantage while claiming to lose $640 million in 2019

There were also similar discrepancies in many nonprofit hospitals’ tax filings.

In their federal tax filings, sixty nonprofit hospitals claimed to lose $863.8 million on Medicare. This claimed loss was 2,985% greater on hospitals’ 990 tax filings than on their Medicare Cost Reports.

The report found that the state’s hospitals charged 280% of Medicare rates on average to privately insured patients. The same hospital systems received more than an estimated $1.8 billion in tax exemptions during the same year.

Folwell’s office said it raises serious concerns over hospitals’ commitment to their patients and their charitable mission and the costs passed on to the nearly 740,000 members of the State Health Plan, which is facing fiscal insolvency in less than three years unless costs are cut.

Dee Jones, Executive Director for the State Health Plan, said the plan is not on a sustainable financial path, and they have implemented the Clear Pricing Project to tackle healthcare affordability, price transparency, and sustainability by utilizing a reference-based pricing model based on Medicare

“Major hospital systems have refused to participate in this effort, citing they couldn’t afford to take a reduced rate that was referenced to Medicare,” she said. “This report that you have before you proves that, in fact, they can afford it and are profiting from Medicare, not losing money on it. Bottom line is that the state health plan, including the members we serve, is paying too much for healthcare, and medical inflation is coming, and we’re not prepared.”

The North Carolina Healthcare Association issued a statement on its website in response to Treasurer Folwell’s report. “The latest report commissioned by Treasurer Folwell continues a pattern of reports that have used misinformation and half-truths and that make inaccurate conclusions. This report, like others the Treasurer has commissioned, fails to account for the incredible complexity of our healthcare system, including health insurance companies’ role in rising costs, and does nothing to advance affordable, high-quality healthcare in our state.”