The Consumer Price Index (CPI) rose 0.4% in September, greater than the increases in July and August and higher than projections, according to the latest release from the Bureau of Labor Statistics. On an annual basis, prices have increased 8.2%.

This new data underscores the insufficiency thus far of the Federal Reserve’s actions, which has raised interest rates 0.75 percentage points at the last three meetings in attempts to tamp down on prices.

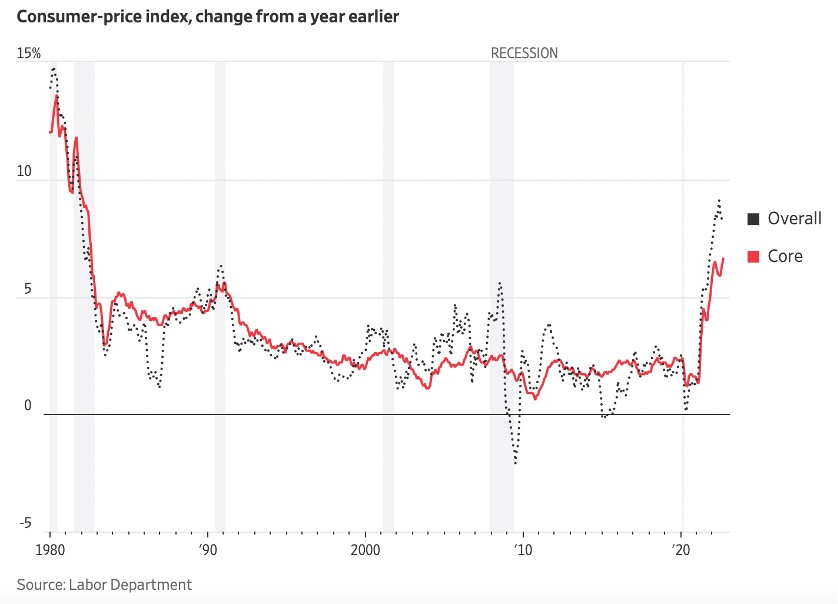

So-called core inflation, which excludes food and energy, rose 0.6% in August, bringing the annual rise up to 6.6%. This is above market forecasts and is the highest annual rate since 1982.

The gasoline index declined 4.9% over the month, smaller than the 10.6% decrease in August. Though this did drive a decrease of 2.1% in the broader energy index over the month, the gasoline index is still up 18.2% over the year.

As I wrote last month, the recent slight decline in prices at the pump is likely at least partially attributable to the Biden Administration’s decision to drain 180 million barrels from the Strategic Petroleum Reserve (SPR), which is now at the lowest level since 1985, according to Reuters. Overall inflation is likely to jump higher for October because gas prices are climbing again, up an average of 20 cents per gallon since the last week of September.

Meanwhile, utilities, shelter, and medical care services are up 2.9%, 0.7%, and 1.0% over the month, respectively. Utility prices are up a whopping 33.1% over the past year.

Transportation services, including mass transit and airfare, rose 1.9% over the month and 14.6% over the year.

The food index rose 0.8% in September and 11.2% over the year. Groceries are up 13.0% over the year, a devastating setback for low-income families in particular, who spend a greater share of their income on food.

CPI’s annual rate has been running at 5.0% or more since May 2021. As the Federal Reserve continues to make changes this late in the game, workers’ budgets are hurting. Real average hourly earnings decreased 0.1% in September after increases in July and August. Over the year, real average hourly earnings are down 3.0%, a level unacceptable to working families, or anyone saving for the future.

In North Carolina, a recent Civitas poll found that more than half of the population finds it difficult to afford food (52.9%) and gasoline (56.5%). Nearly 85% believe the nation is heading toward recession.

Government deficit spending and money printing caused today’s inflation. It continues to impact the average American’s wallet every day, preventing them from saving for the future and causing some to sacrifice their dreams. Washington’s recklessness has consequences. Inflation is an implicit tax on workers, harming the poor most. If we continue further into recession, low-income families will disproportionately endure the effects.